In the competitive world of trucking, every mile is an investment. That’s why having strong and reliable commercial truck insurance isn’t optional — it’s essential.

At UNITY FINANCIAL NETWORK, we understand the daily challenges faced by truck owners and trucking companies across the U.S. That’s why we’ve created customized commercial insurance solutions designed to give you the peace of mind you need to keep your business moving forward.

Why choose us for

your truck insurance?

![]() Comprehensive Coverage

Comprehensive Coverage

We protect your business from every angle. Our policies include liability, cargo, commercial auto insurance, and more.

![]() Trucking Insurance Experts

Trucking Insurance Experts

Our team has extensive experience in the transportation industry. We understand what you need and offer clear guidance to help you make confident decisions.

![]() Personalized Attention

Personalized Attention

Your business matters to us. We offer dedicated service built on trust and focused on long-term relationships.

![]() Fast and Efficient Processes

Fast and Efficient Processes

We know your time is valuable. We help you get your policy quickly and easily—without the hassle.

![]() Access to Over 50 Insurance Companies

Access to Over 50 Insurance Companies

We work with top-rated carriers (A, B Rated, Risk Retention Groups, and Non-Rated), allowing us to find the right commercial insurance for your type of trucking and budget.

![]() Available in Over 12 States

Available in Over 12 States

We provide expert advice across the country so you can protect your fleet—no matter where you are.

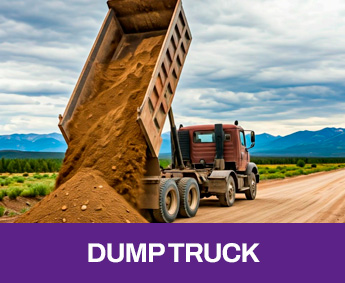

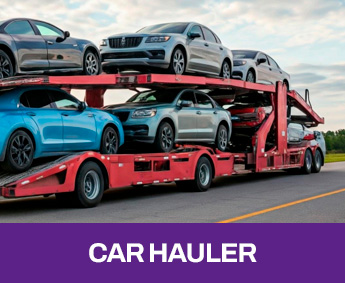

Our trucking insurance

services include:

Truck liability insurance

Cargo insurance

Get insured by experts

At UNITY FINANCIAL NETWORK, we’re ready to help you protect what matters most: your investment, your trucks, and your peace of mind.

Request your free, personalized quote today.

We want to be your partner on the road to success!

Coverages

At UNITY FINANCIAL NETWORK, we offer a complete range of commercial truck insurance coverages designed to protect your operation at every stage of the journey. These policies are essential to stay compliant with FMCSA regulations and keep your business safe and running smoothly.

Liability Insurance

Required by the FMCSA, this coverage protects your business from claims for property damage or bodily injury caused during transit. It’s the legal and operational foundation for any trucking business.

Motor Truck Cargo (MTC)

Covers cargo against theft, damage, or loss while in transit. We help you meet all contractual requirements and ensure your load is protected at all times.

Physical Damage

Covers physical damage to your truck and trailer due to accidents, theft, vandalism, or natural disasters. Safeguard your most valuable assets and avoid costly downtime.

General Liability

Provides protection for non-driving-related incidents, such as loading/unloading accidents or injuries on your premises. A key coverage to defend your business from third-party claims.

Trailer Interchange

Ideal if you use interchangeable or leased trailers. Covers damage or loss while the trailer is in your possession during transport.

Non-Owned Trailer

Do you use trailers that aren’t owned by your company? This coverage protects them while in use for your business operations.

Umbrella Policy

An added layer of protection that extends your standard coverage limits. Ideal for defending your assets against major claims or high-impact events.

Excess Liability

Provides extra protection when your primary policy limits are exceeded. A smart choice for businesses with higher risk exposure.

Worker’s Compensation

Mandatory in many states, this coverage protects your drivers and employees from work-related injuries or illnesses. Take care of your team and stay compliant.

PIP (Personal Injury Protection)

Covers medical expenses for drivers and passengers in case of an accident. Required in states like Florida and New Jersey—essential for protecting everyone inside the vehicle.

Non-Trucking Liability

Covers your truck when it’s not being used for business purposes, such as during rest or personal use. Ideal for owner-operators.

Bobtail Insurance

Essential coverage for when the truck is without a trailer and not engaged in active business. Common among independent drivers and small fleets.

Garage Keepers Liability

Designed for repair shops, dealerships, and automotive businesses. Protects customer vehicles while in your care on your premises.

Not sure which coverage is best for your business?

At UNITY FINANCIAL NETWORK, we’re here to guide you. Our full range of commercial truck insurance options helps keep you compliant with FMCSA rules and protects every part of your operation.